Insights and perspectives

T+1 Settlement: A Structural Transformation for Asset Managers

In an effort to reduce counterparty risk exposure and align with major international financial markets, the European Union approved the transition to a T+1 settlement cycle on June 18, 2025. The shift from T+2 to T+1, scheduled for October 11, 2027, means that the timeframe between trade execution and final settlement-delivery will be reduced by one business day.

The expected benefits are :

- Improved market liquidity through faster release of collateral and guarantees

- Operational efficiency gains with an estimated reduction in financing costs

- A decrease in settlement failures through reduced exposure periods, limiting counterparty default risks

- Smoother cross-border transactions with jurisdictions that have already adopted T+1 through better synchronization of settlement cycles

However, these gains will only materialize with rigorous and appropriate preparation.

How to Prepare Effectively

In summary, the transition to T+1 settlement-delivery reconfigures how asset management companies manage their operations by essentially shifting them to T+0. This tightening of operational windows requires real-time data exchanges with brokers, custodians, and infrastructures. It also forces funds to rethink liquidity management with earlier cash requirements and an induced gap between asset and liability settlement cycles.

To address these challenges, a pragmatic roadmap must be developed around four key pillars:

IT Systems Modernization

Before undertaking the transformation, a diagnostic of impacted processes (trading, middle/back-office, cash, OST, securities lending) will identify bottlenecks and establish a precise, targeted roadmap.

The priority then consists of generalizing straight-through processing by ensuring matching and affirmation on trade date and automating reconciliations. This transformation aims to eliminate manual interventions, synchronize all links in the chain, and guarantee order confirmations within the first hours of trading. All of this will only be possible through harmonized communication infrastructure.

Harmonization of Exchanges

The success of T+1 relies on aligning protocols among all actors (brokers, CCPs, CSDs, custodians). This involves adopting harmonized standards (FIX, ISO 20022) as well as common reference data for securities, counterparties, IBANs, and SSIs, ensuring quality and speed of information exchanges within T+0/T+1 windows.

Liquidity Management Optimization

The transition to T+1 shortens the liquidity retention period. It requires strengthened cash forecasting and intraday position monitoring to anticipate accelerated treasury needs between transaction date and settlement date.

Managing the Asset/Liability Gap

But the main challenge lies in the gap between assets and liabilities. The settlement cycle for fund shares is not affected by the transition to T+1; it can remain at T+2, T+3, or T+4 (most funds settling at T+3/T+4). This creates a misalignment between the liability cycle and that of the underlying assets.

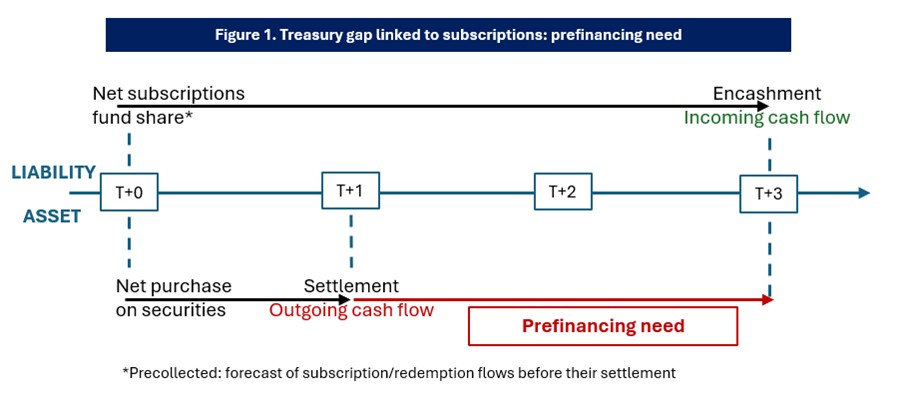

In the case of share subscriptions, the liquidity needed for securities purchases must be available by T+1, while the settlement of the fund share will occur at T+3, for example (diagram 1). This therefore generates a prefinancing need at T+1.

The UCITS directive sets limits on the amount of liquidity that funds can borrow (Articles 50, 52, and 83). The ability to meet these requirements can be affected by settlement gaps that temporarily increase cash needs.

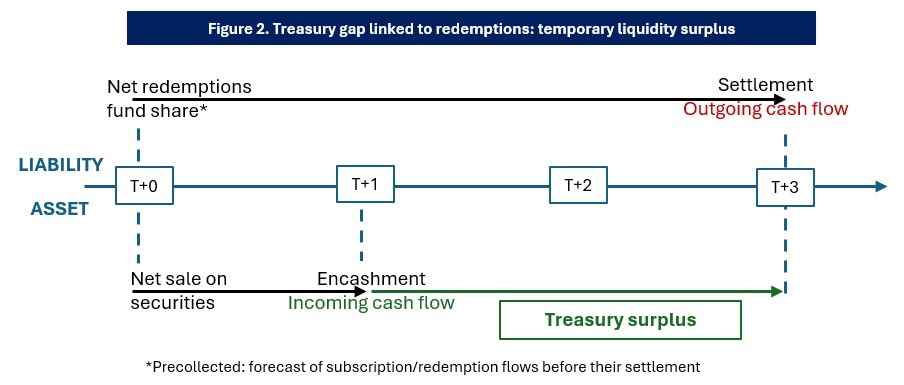

In the case of share redemptions, liquidity from securities sales is available by T+1, creating a temporary cash surplus until the settlement of share redemptions (diagram 2). Liquidity ratios and the deposit amount limits imposed by the UCITS directive may not be met if this surplus is not properly managed. Fund performance can also be affected (cash drag).

The gap between flows from securities transactions and those from share subscriptions or redemptions can generate either a prefinancing need (in case of subscriptions) or a temporary liquidity surplus (in case of redemptions). Faced with this asymmetry, two approaches emerge for asset management companies.

- The first consists of integrating this gap into a liquidity management optimization framework: strengthen cash forecasts, size short-term financing lines, control deposit concentration, and limit cash drag from temporary surpluses.

- The second aims to align settlement cycles as closely as possible: synchronize the liability cycle (NAV, subscriptions/redemptions) with that of assets. However, this requires strong automation of NAV production (approximately 4 hours instead of the current 28 hours), harmonization of exchanges with distributors, and operational capacity to process flows in near-real time. This brings us back to the first two improvement axes: IT systems modernization and harmonization of exchanges.

Funds will likely need to combine these two approaches: transition to a T+1 settlement cycle for liabilities when possible while optimizing liquidity management for products where this transition is structurally impossible in the short term. The challenge therefore consists of reducing settlement delays as much as possible while implementing treasury management mechanisms to absorb the residual gap.

Ultimately, the transition to T+1 is as much a regulatory evolution as an operations industrialization project requiring end-to-end automation, exchange standardization, and improved treasury management to address the asset-liability gap. But beyond technological investments, the success of this transition relies on mastering change management: employee training, redesign of internal procedures, and implementation of dedicated project governance.

Contact us to transform the T+1 challenge into an opportunity for operational improvement.

Sources :

AFG : T+1 – ANTICIPER LA NOUVELLE ÈRE DU RÈGLEMENT DES TITRES

ESMA : HIGH-LEVEL ROADMAP TO T+1 SECURITIES SETTLEMENT IN THE EU