Insights and perspectives

Sustainability — How to face the challenge of regulatory alignment ?

A complex regulatory framework

On March 2018, EU has released an action plan for financing sustainable growth. The action plan outlines three objectives and ten reforms:

Objective #1 — Reorienting capital flows towards sustainable investment

- Establishing an EU classification system for sustainability activities

- Creating standards and labels for green financial products*

- Fostering investment in sustainable projects

- Incorporating sustainability when providing investment advice

- Developing sustainability benchmarks

Objective #2 — Mainstreaming sustainability into risk management

6. Better integrating sustainability in ratings and research

7. Clarifying institutional investors and asset managers’ duties

8. Incorporating sustainability in prudential requirements

Objective #3 — Fostering transparency and long-termism in financial and economic activity

9. Strengthening sustainability disclosure and accounting rulemaking

10. Fostering sustainable corporate governance and attenuating short-termism in capital markets

Final objective is to define an ESG (Environmental, Social and Governance ) set of standards measuring a business’ impact on society, environment, and how transparent and accountable it is.

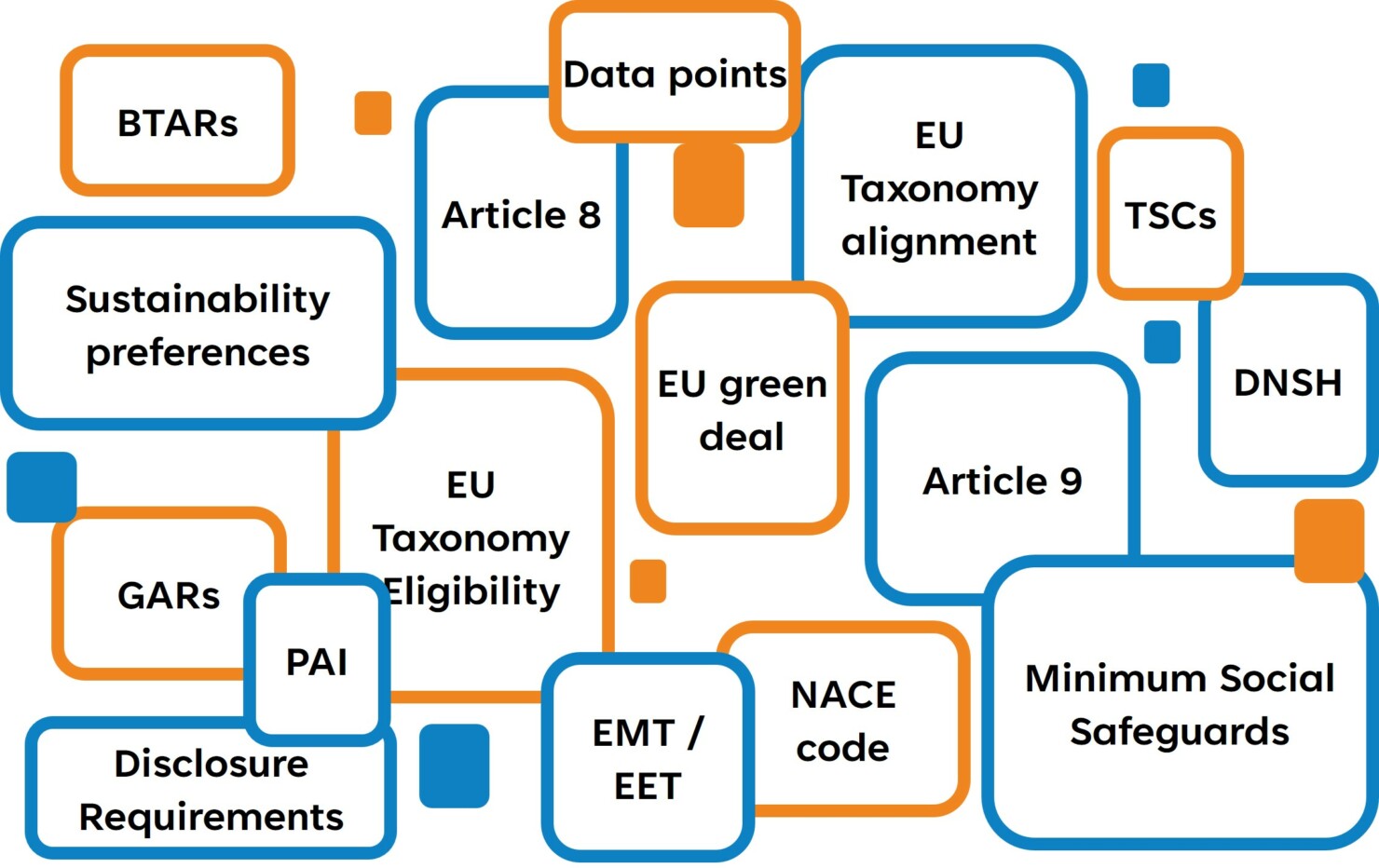

This action plan result in the emergence and revision of several interconnected regulations and a multitude of barbaric acronyms.

In the plethora of regulatory texts, we have highlighted four (CSDR, SFDR, EU TAXONOMY & MIFID II) which will be the backbone of the work to be undertaken by financial institutions.

CSRD — Corporate Sustainability Reporting Directive

It should be be noticed that CSDR will ultimately replace NFRD (Non-Financial Reporting Directive). NFRD started out in 2018 as a natural extension to annual financial reporting requirements, providing companies with guidelines on how to disclose their approach for managing environmental and social challenges.

CSRD new directive modernizes and strengthens the rules regarding social and environmental information that companies must report.

- Additional information on top of NFRD to be disclosed among which the alignment of the business model and strategy with the objective to achieve climate neutrality by 2050, the targets, the role of the administrative, management and governance bodies, the policies, the most significant negative impacts, the risks, the way the information has been identified… together with information about company’s value chain (operations, products and services, business relationships and supply chain…).

- Double materiality principle (two-side perspective) one side is how ESG factors may impact the company and the other side is how the company impacts ESG factors.

- Independent third-party insurance (starting with limited to reasonable level of insurance).

- Electronic reporting format available.

- Inclusion in the Management Report as a single report in a digital, machine-readable format.

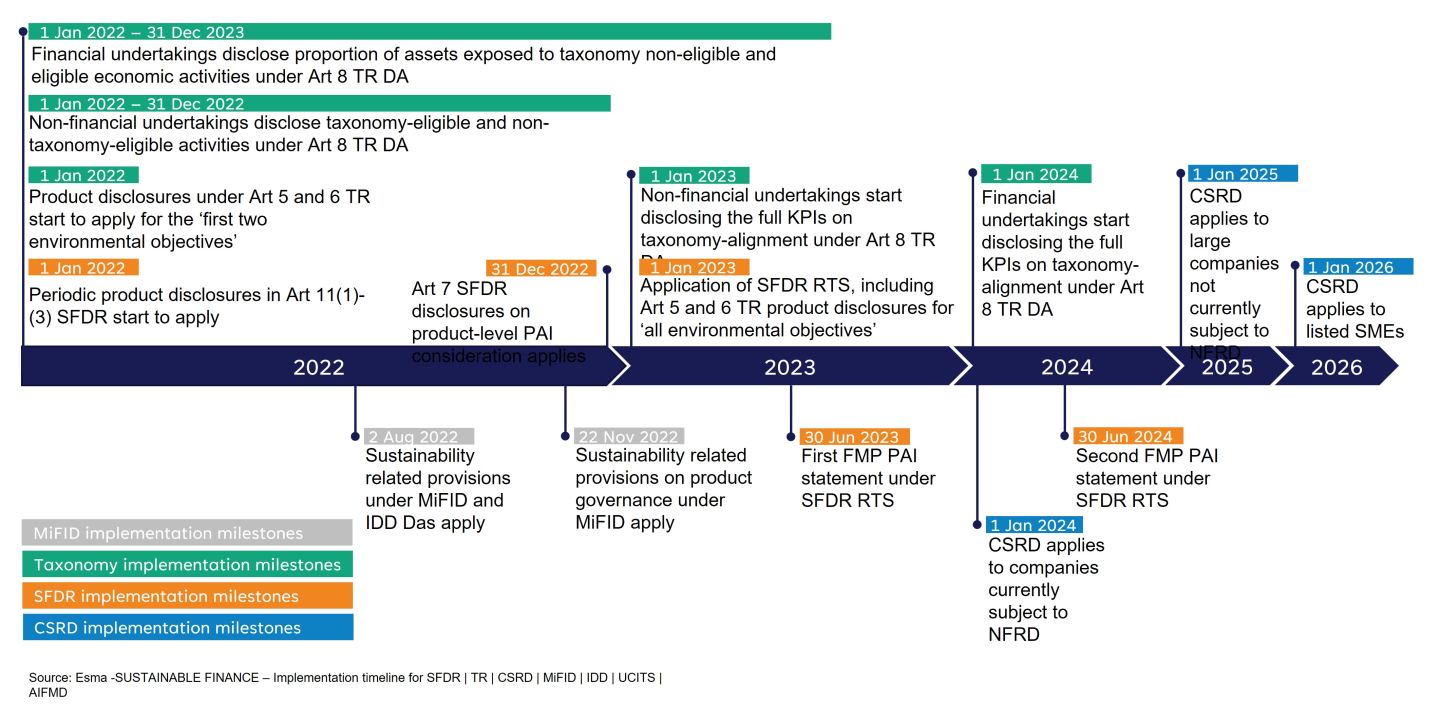

A broader set of large companies, as well as listed SMEs, will now be required to report on sustainability – approximately 50 000 companies in total. CSDR will apply with a progressive calendar:

- As of January 1st 2024 (initial publication during calendar year 2025) for companies already reporting under NFRD.

- As of January 1st 2025 (initial publication during calendar year 2026) for large companies not currently subject to NFRD and meeting at least two of three criteria (balance sheet 20M € + / revenue 40 M € + / more than 250 employees).

- As of January 1st 2026 (initial publication during calendar year 2027) for SMEs meeting at least two criteria (balance sheet 4M € + / revenue 8M € + / more than 50 employees). SME’s will be subject to a limited set of standards than the general set of CSDF standards.

- As of January 1st 2027 (initial publication during calendar year 2029) for non-European companies meeting specific criteria (company listed on EU regulated markets + annual net turnover in EU territory of 150M € + subsidiary in the EU).*

Companies subject to the CSDR will have to report according to European Sustainability Reporting Standards (ESRS). The draft standards are developed by the EFRAG (European Financial Reporting Advisory Group). This will end the multiple existing frameworks available to companies for reporting (OECD, ISO 26000, UN Global Impact, Global Reporting Initiative, Sustainability Accounting Standards Board, CDP, Climate Disclosure Standards Board, International Integrated Reporting Council …).

The rules introduced by the Non-Financial Reporting Directive (NFRD) remain in force until companies apply the new rules of CSRD.

SFDR - Sustainable Finance Disclosure Regulation

SFDR objectives are on one-side to make comparison on product’s sustainability factors easier for end-investors and on the other side to mitigate greenwashing on financial instruments. It establishes a level playing field for product manufacturers for the measurement and disclosure of sustainability factors.

SFDR applies to all Financial Market Participants (investment firm, asset managers, insurance, credit Institution…) and to all products (portfolio managed, alternative investment funds, undertakings for the collective investment in transferable securities, insurance-based investment products, pan-European personal pension, pension scheme, pension product…). It should be noticed that it also applies to non-EU FMPs that are distributing into the EU.

SFDR requirements apply both at company and at product level with different sets of disclosure requirements related to sustainability information. All disclosures shall be communicated through different channels whether they are related to entity (website) or products (pre-contractual documents such as prospectus and KID (Key Information Document), website and periodic reporting).

What should be disclosed?

At entity level:

- Principal adverse impacts of investment decisions on sustainability factors: entities have to disclose the negative consequences of investment decisions on sustainability factors and the policies to identify and mitigate them.

- Integration of sustainability risks into investment decisions: entities have to disclose where an ESG event could negatively impact material investment and align their remuneration policies with sustainability risk management.

- Alignment with the EU taxonomy: entities have to assess EU taxonomy alignment at firm level

At product level:

- SFDR classifies financial products into three categories: articles 6, 8, and 9. Article 6 products have no ESG related objectives. Article 8, also known as “light green” products, have to include the promotion of environmental or social characteristics. Article 9, also known as “dark green”, have to include the promotion of sustainable investments as an explicit objective.

- Pre-contractual disclosures cover similar areas to entity-level disclosures around the integration of sustainability risks and principal adverse impacts. They also contain information on EU taxonomy alignment, how objectives and benchmark (index) are planned to be met, where the methodologies used for the calculation of the index can be found…

- Periodic reporting disclosures include information of principal adverse impacts on sustainability factors, the extent to which environmental and social characteristics are met and a comparison between the product impact and the impacts of a designated index. Information related to EU Taxonomy and ‘do no significant harm’ criteria must also be disclosed.

- Website disclosures include methodologies used to assess, measure and monitor the environment and social characteristics or the impact of sustainable investments (including data sources and relevant sustainability indicators) but also all information required in pre-contractual (Article 8 & 9) and periodic (Article 11) documentation.

EU Taxonomy

The EU taxonomy is a classification system for sustainable economic activities that translates the EU’s climate & environmental objectives into criteria for specific economic activities. The EU taxonomy is above all a robust & science-based transparency tool for companies and investors. It provides a common understanding of green economic activities and creates a common language that can be used across sectors and industries, thereby standardizing the meaning of sustainable activity.

EU taxonomy only focuses on the “environment” dimension.

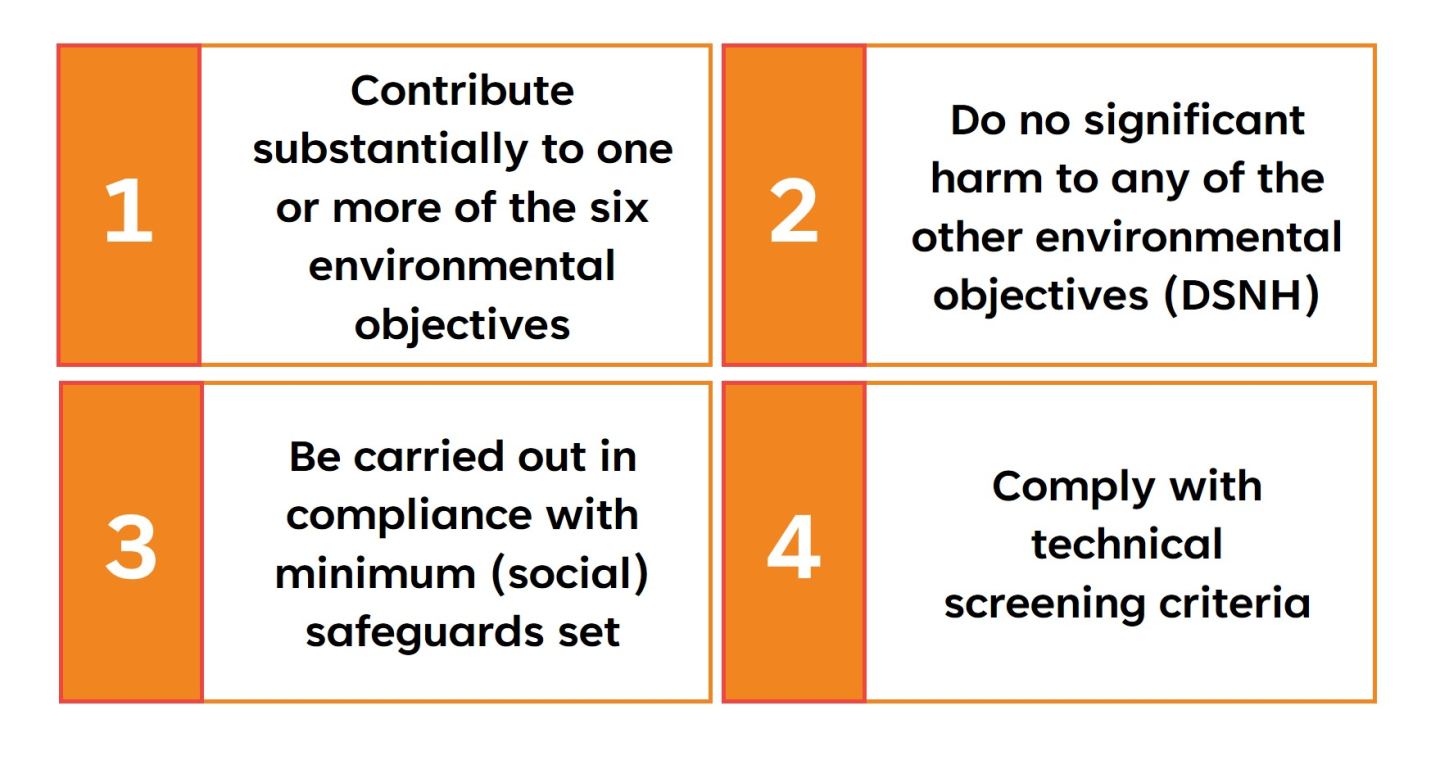

EU taxonomy sets out four conditions an economic activity must comply with in order to qualify as environmentally sustainable. A qualifying activity must:

Environmental objectives are divided into 6 categories :

1. Climate change mitigation

2. Climate change adaptation

3. Sustainable use of water

4. Circular economy

5. Pollution prevention

6. Biodiversity protection

Industry activities are divided into 13 NACE (Nomenclature des Activités de la Communauté Européenne) macro sectors and more than 100 NACE activities.

Each activity for each objective has its own Technical Screening Standards (TSC) and DNSH criteria.

In order to measure and compare sustainability performance, the EU taxonomy defines some Key Performance Indicators (KPIs) to report on. These KPIs are different for financial and non-financial companies.

For non-financial companies, objective is to report the percentage of company Turnover, Capex, and Opex associated with taxonomy eligible / taxonomy aligned activities. Disclosure of the information is mandatory in non-financial reporting according to NFRD / CSDR requirements.

For financial companies (banks, credit institutions, asset managers, insurers…) and given their special role in the economy, KPIs are different. Non exhaustive examples:

- Assets managers will have to report on the proportion of investments made in taxonomy aligned economic activities in the value of all investments managed.

- Credit Institutions will have to report Green Asset Ratio (GAR) that include the proportion of exposures that are taxonomy aligned compared to the total assets, the proportion of fees and commission income that are derived from taxonomy aligned businesses, the proportion of off balance sheet exposures (underlying assets, guarantees…) that are taxonomy aligned or for credit institutions with trading activity and trading portfolio over a certain threshold, obligation to disclose proportion of taxonomy aligned activities of investee undertakings.

- Insurers will have to report on the share of assets from the funds collected from underwriting activities that are taxonomy aligned.

- …

Disclosure of the information is mandatory either in pre-contractual document, periodic reporting or in annual non-financial reporting under SFDR, NFRD or CSDR requirements.

MIFID II — Markets in Financial Instruments Directive

Delegated Regulation (EU) 2021⁄1253 of 21 April 2021 has amended Delegated Regulation (EU) 2017⁄565 as regards the integration of sustainability factors, risks and preferences into certain organizational requirements and operating conditions for investment firms.

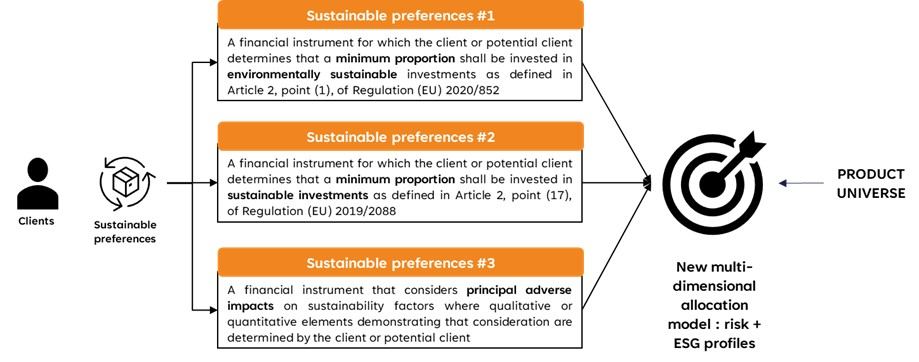

Originally with MiFID II, financial institutions must know the risk profile of their customers, notably through the suitability test. Now, the suitability assessment should also identify the sustainability preferences. This is not about adding a single question to the MiFID II questionnaire. It is about understanding in detail the client desired ESG strategy, identifying the trade-offs that individuals are willing to make and helping them formalize their expectations.

It is also about an upheaval in advisory to provide client with investment proposals which is leading to a new multidimensional approach to investment combining risk and ESG client profile.

MiFID II is not only about client sustainability preferences and client advisory processes, but also integrating sustainability risks into organizational requirements, into policies and procedures for risk management and conflict of interests.

Even if some key regulatory deadlines are behind us, major changes are still to come…

The regulatory timetable might suggest that the main deadlines are now behind us (except the implementation of CSDR). But this is a false perspective as the real revolution in the implementation of these regulations is yet to come. Indeed, customer awareness and sensitivity to sustainability imperatives, increased transparency at product and entity level will profoundly change business offerings and processes in the coming years.

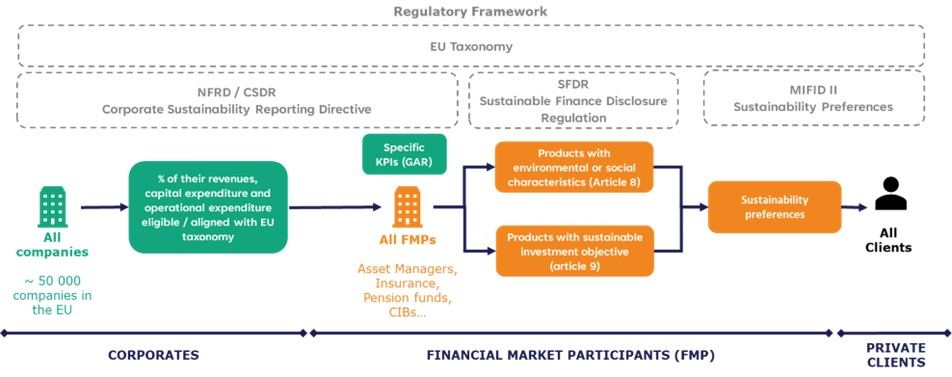

Regulatory framework is embedded across the value chain of the financial ecosystem

The regulation is embedded across the financial ecosystem value chain from corporate companies to final private end-clients. This will lead to a virtuous cycle to enhance sustainability across the financial ecosystem.

The corporate companies will be subject to CSDR and will, as such, disclose non-financial information that will feed financial market participants.

In their turn, financial market participants will be able to comply with their NFRD / CSDR obligations among which is the Green Asset Ratio reporting. But first and foremost, it will be the opportunity for them to be more sustainable in their role of financing the economy. This will be a direct contribution to the objective of re-directing flows toward sustainable activities.

Financial market participants will also be, as product manufacturers, subject to SFDR. As such, they will have to design more sustainable products thanks to the information provided by the corporates.

Finally, financial market participants, as product distributors, will have to comply with MiFID II and take into account the sustainable preferences expressed by the end clients. End clients will also play a central role by forcing product manufacturers to design products matching their sustainable preferences.

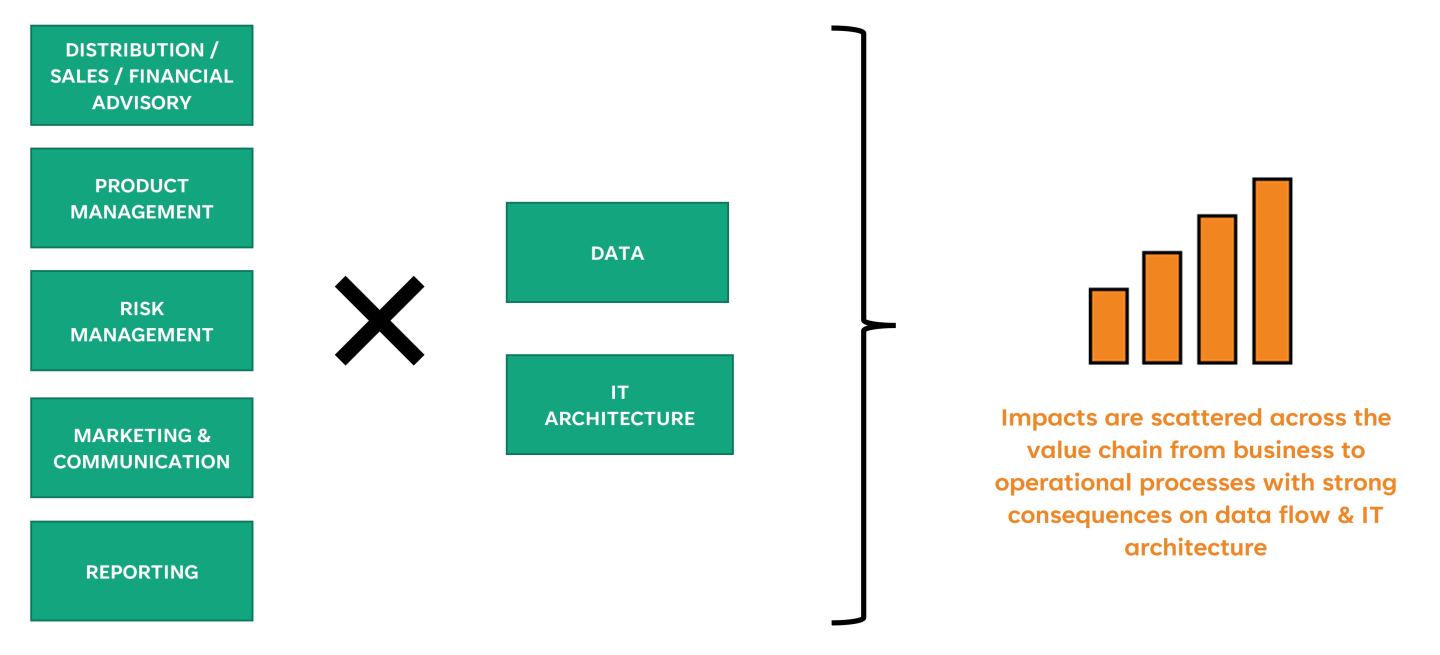

Impacts are huge and scattered across the value chain

The impacts are very different in nature, but in all cases, they are highly impactful. Impacts are ranging from business to operational processes with strong emphasis on data management and IT architecture. Impacts will also differ depending on the role of the FMP – credit institutions, asset managers, private banks…

Indeed, it will be about reshaping the sales / distribution processes for both institutional and private clients and adapting the product universe by selecting products in line with clients’ expectations and regulatory constraints. It will also be about amending the development product processes and the risk management processes to integrate ESG factors.

Increased transparency will also have a direct impact on how organizations will market and communicate their positioning and offers. Greenwashing and communication misaligned with public information will be widely sanctioned by customers.

Transparency is also about enhanced reporting capabilities. Reporting that will require to manipulate thousands of heterogeneous data from internal and external sources.

Who can imagine that information systems will be able to support all these changes without minimum revamping?

Conclusion

Sustainability is to be considered as a major transformation similar or even greater than digital transformation. This strategic move will disrupt the way business is done. In that sense, sustainability is a long transformation journey. Regulation is just the tip of the iceberg, but sustainability is a tsunami that will affect all levels of a company, especially for FMPs and their very specific role in the economy.