Insights and perspectives

Private Equity: The Rise of Operating Partners, Beyond Simple Financial Engineering

The Private Equity (PE) sector is undergoing a major transformation in an uncertain economic context. With investment targets becoming scarcer, funds are focusing more on optimizing existing assets rather than multiplying deals. At the same time, rising interest rates are limiting access to liquidity, prompting market participants to focus on operational improvement as the main growth lever.

Since the 2008 financial crisis, the U.S. has strengthened its operational optimization approach, integrating business transformation as a key lever for value creation, while maintaining traditional financial strategies. It is in this context that the role of Operating Partner has emerged and continues to develop, responding to the need for funds to support their investments in improving their performance.

Today, with persistently high interest rates, limited partners (LPs), investors in PE funds, favor strategies based on high-performance operational teams rather than financial engineering. They are looking for specific skills in operations optimization, requiring sector and functional expertise to improve portfolio performance and optimize future investments.

The emergence and evolution of the role of Operating Partner in the United States and Europe

Genesis of the role of Operating Partner in Private Equity:

The role of Operating Partner in Private Equity (PE) originated in the United States in the 2000s and particularly developed after the 2008 financial crisis. At that time, value creation in portfolio companies was mainly based on financial engineering strategies, such as leverage (LBO), financial restructuring and cost reduction. However, with the increase in competition in the PE market and the decrease in opportunities for easy financing, the focus has gradually shifted to creating value through operational improvement.

Today, the role of Operating Partners has been considerably strengthened. According to a recent study by PWC1, 47% of value creation in Private Equity now comes from operational initiatives (vs. Financial Engineering). This development shows the extent to which operational optimization and organic growth have become the priorities of the funds. The function has reached a certain maturity, particularly in mid-cap private equity funds and venture growth/late-stage funds.

Operating Partners, a variety of profiles at the service of company performance:

In private equity, Operating Partners provide operational expertise that complements dealmakers, intervening throughout the investment cycle. Coming from the management of companies (CEO, COO, CFO) or specialized in transformation, they optimize growth and performance.

The Operating Partner is involved at each stage of the investment life cycle:

- Prior to the acquisition, he analyzes the strengths and weaknesses of the target company to identify areas for improvement and opportunities for value creation, bringing an operational dimension to concretely assess the feasibility and impact of transformation initiatives

- During the ownership phase, he collaborates with the management teams to deploy a transformation plan, which may include process optimization, digitalization, innovation or cost reduction

- During the sale, he ensures that the initiatives implemented have strengthened the performance and maximized the valuation of the company

Operating Partners play a key role in the execution of development strategies, in collaboration with the management teams. Their expertise in transformation, acquisitions and organization strengthens value creation in private equity and venture capital.

The gradual rise of the role in Europe and France:

While the Operating Partners model is well established in the United States, its adoption in Europe and France is more recent and more gradual. According to the White Paper on Operating Partners in France, published by France Invest2, the profession is expanding rapidly, in particular because of several factors:

- The increase in the number of deals requiring transformation and restructuring skills rather than simple financial optimization

- Funds are becoming increasingly aware of the importance of business value creation

- A growing concern among investment funds to have a positive social and environmental impact

There is a real awareness of the impact of this role, as shown by the results of the assessments carried out by Alvarez and Marsal in partnership with France Invest2 since 2021, and which confronts expectations and results: in 2021, the usefulness of Operating Partners was well “felt”; in 2023, their role in value creation was affirmed, with figures to support this; In 2024, it will be confirmed, both in terms of observed performance and in terms of the structuring of the profession. As part of the 2024 survey, around thirty managers were asked about the impact of Operating Partners.

The growth in the number of Operating Partners reflects an increased awareness of their added value.

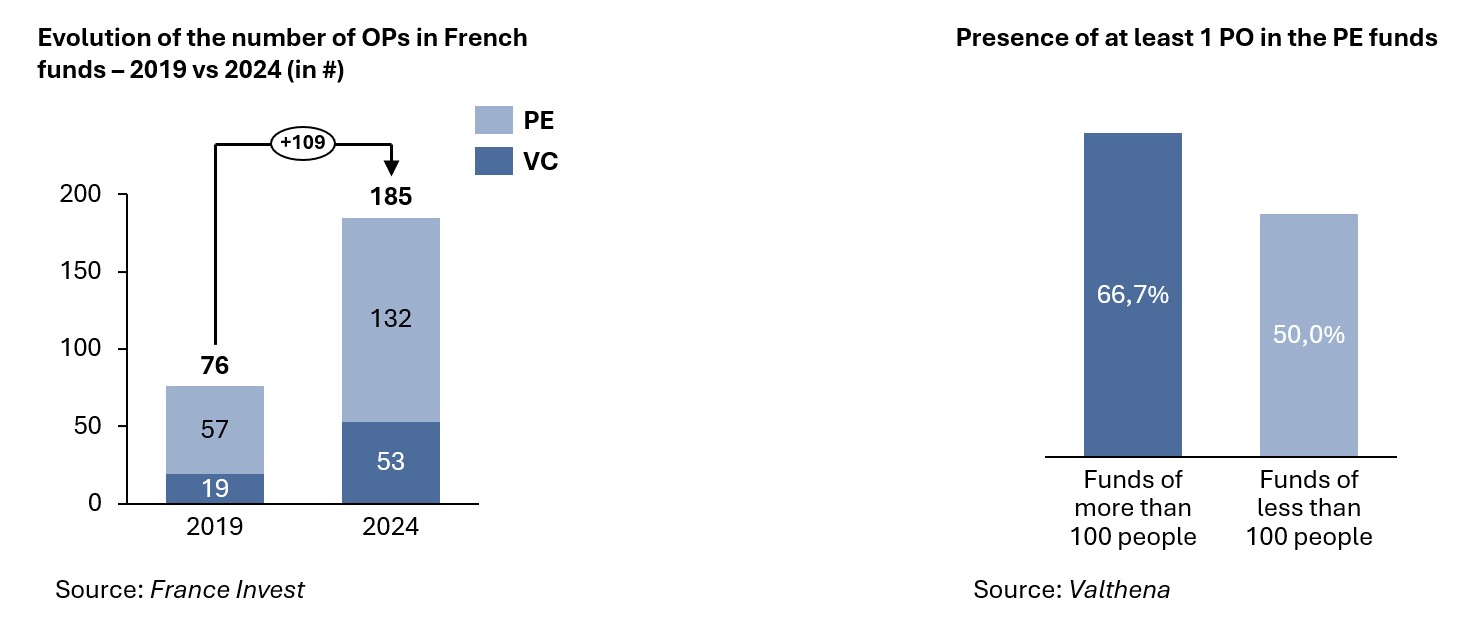

According to France Invest2, the number of Operating Partners in France has increased 2.4‑fold between 2019 and 2024, from 76 to 185. Over this period, 109 OPs joined the teams of investment funds, including 75 in Private Equity and 34 in Venture Capital.

In 2024, 30% of funds have at least1 OP, with the number of funds integrating at least one Operating Partner having increased by 80%, reaching 84 funds (out of a sample of 283 French funds). Mid-Cap Private Equity and Venture Capital Growth/Late Stage funds have mainly strengthened this function, representing 47% and 56% of management companies respectively. Some funds have even structured an entire team of Operating Partners, representing a significant part of their workforce. This is the case of LBO France, a precursor in this field, where the Operating Partners team has been in place since the 2010s and now constitutes more than 10% of the fund’s workforce, in order to align with the fund strategy to focus on operational performance.

Obstacles related to the solicitation of an OP:

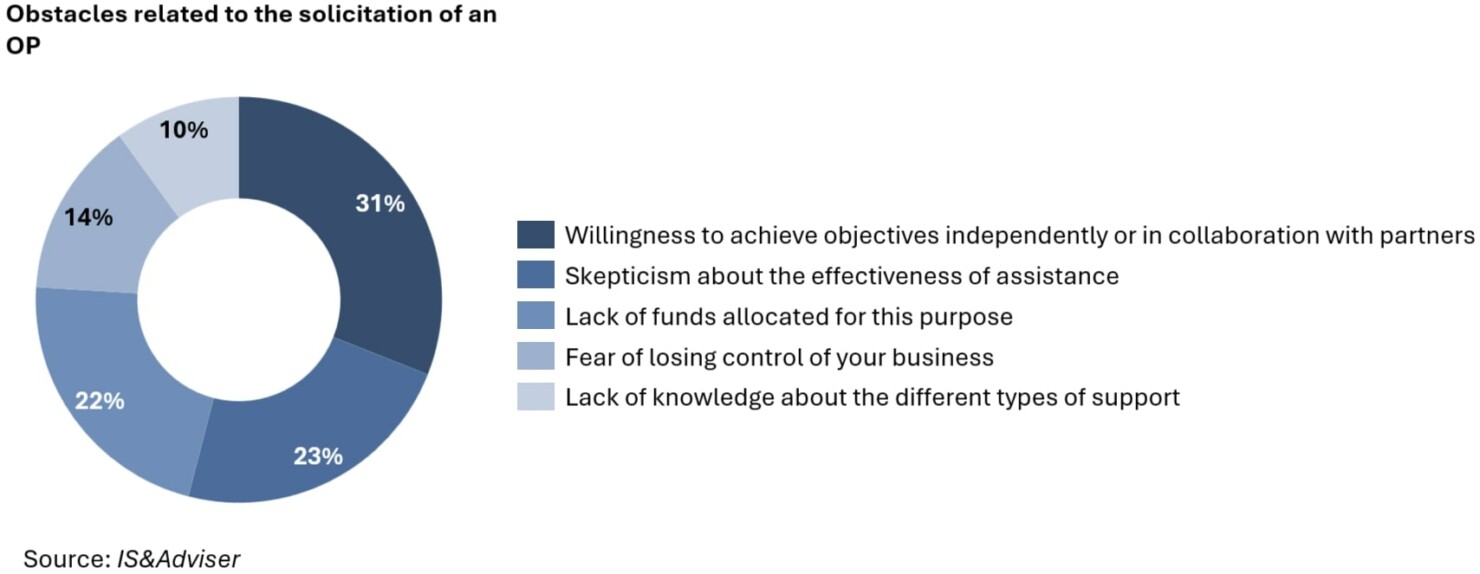

However, the European market is still reluctant to accept this model, for several reasons. First of all, the weight of Private Equity in the economic fabric is much less in Europe than in the United States, where capital investment by funds is an almost systematic practice. In France and Europe, the number of companies with an investment fund in its capital remains more limited, which slows down the adoption of more integrated models such as Operating Partners. Secondly, there is still a cultural reluctance to open strategic data to external experts. Operating Partners, who operate at the interface between the interests of the company and those of its shareholders, are sometimes perceived as ambiguous actors, or even as “spies” serving investors more than the management of the companies in the portfolio. Finally, the still very financial culture of European Private Equity traditionally favors financial engineering and transactional arrangements over operational optimization. Combined with fund structures that are often smaller than in the US, this approach limits the ability to invest in internal or external teams dedicated to operational improvement.

Impact of the presence of POs on the company’s performance:

According to data collected by the France Invest2 association, Operating Partners are a proven driver of performance throughout the company’s ownership period, while playing a key role in preventing underperformance.

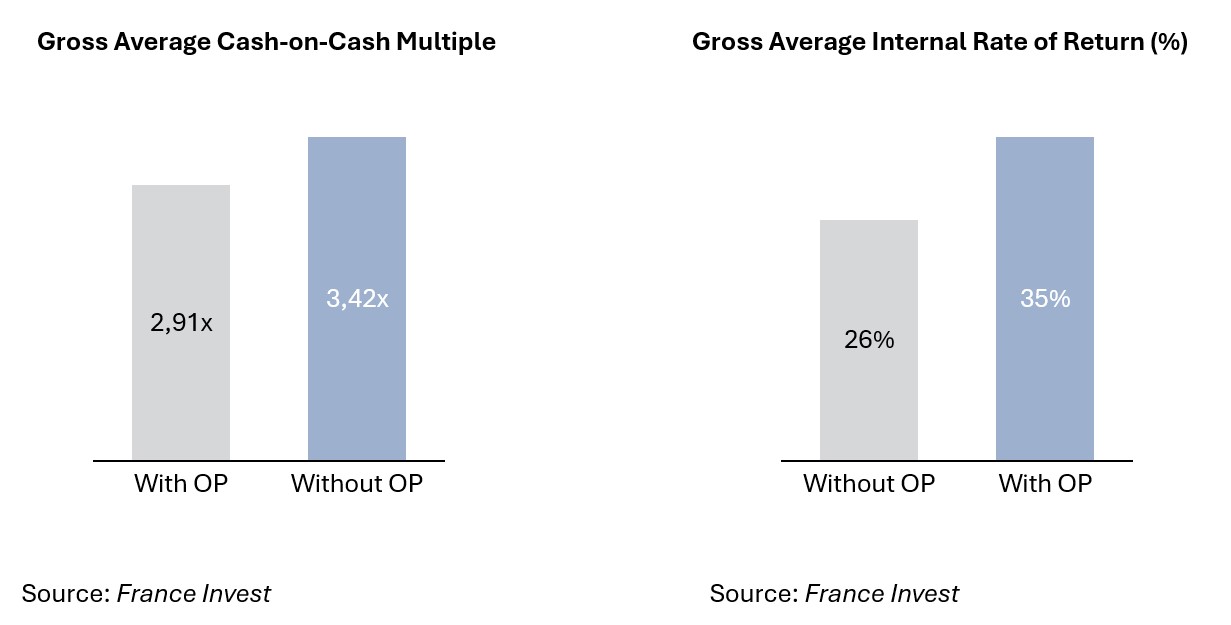

Investments supported by a public service provider record a financial outperformance compared to operations carried out without their intervention, thus allowing value to be created more quickly.

- Average gross IRR is 9 ppt higher (on average 35% with OP vs. 26% without) – Cash on cash multiple is on average 3.4x vs. 2.9x without OP (i.e. 17% higher)

- The value creation linked to the result effect is 37% higher with a PO. This outperformance is due to 50% of the acceleration of organic growth, 35% to better margin management and 15% to better execution of external growth

- The presence of an Operating Partner reduces the risk of the General Partner (GP): there are almost 2x fewer underperforming deals (gross IRR)

Sources:

(1) : How private equity operating partner roles are changing: PwC

(2) : Etude Exclusive Club Operating Partners de France Invest / Alvarez & Marsal Décembre 2024 9460_A&M_454463_PEPI_FR_France invest OP report_FINAL (1).pdf

(3) : L’impact des Operating Partners auprès des chefs d’entreprise (Deloitte) Le métier d’Operating Partner devient essentiel en France dans les opérations de création de valeur | Deloitte France