Insights and perspectives

MLETR: The boost to foster Trade Finance digitalization

France is about to adopt a law based on the MLETR, United Nations model law to allow legal use of electronic format for transferable documents. For global trade actors, this may be the additional nudge to broaden digitalization of the Trade Finance activity, resulting in time, cost, and security benefits.

Trade Finance: Still waiting for the digital revolution

Trade Finance, the set of financial instruments used to facilitate international trade, acts as an essential pillar to secure global exchanges.

Within global trade framework, importers and exporters needs are difficult to align. On one hand, exporters seek to mitigate the risk of non-payment from the importer and want to be paid on time. On the other hand, the importer seeks to mitigate the supply risk from the exporter and optimize its working capital. Trade Finance secure the transaction, banks acting as trusted third party to mitigate payment and supply risks.

However, most of the international trade finance processes still rely on paper documents, largely for legal reasons: In most cases, only physical documents are legally recognized, complicating the transition to fully digitalize processes. Despite significant improvements to digitize papers, automate compliance controls and document checking, or connect to digital platforms, paper remain the main inputs and outputs of a trade finance banking process, generating costs, delays and complexity for the stakeholders.

The MLETR : Towards More Efficient and Secure International Trade

The MLETR (Model Law on Electronic Transferable Records) is part of the solution. Adopted in 2017 by the United Nations Commission on International Trade Law (UNCITRAL), it aims to facilitate the legal use of electronic documents in global trade transactions, paving the way for complete digitization of Trade Finance activity.

This law recognizes the legal value of electronic documents such as bills of lading (B/L), letters of credit, promissory notes, warehouse receipts, both at the national and international levels. By allowing the use of these electronic documents as functional equivalents of their paper versions, the MLETR opens the door to more efficient, faster, and safer trade processes.

While the MLETR has only been adopted by seven countries so far (Bahrain, Belize, Kiribati, Paraguay, Papua New Guinea, Singapore, United Kingdom, and ADGM), other countries are considering it: In France a law based on the MLETR has been adopted by French National Assembly this month and is now to be reviewed by the Senate.

Although its full deployment requires time and concerted efforts, the MLETR represents a decisive step towards smoother, more efficient, and secure international trade.

The Bill of Lading: A typical illustration of the benefits at stake

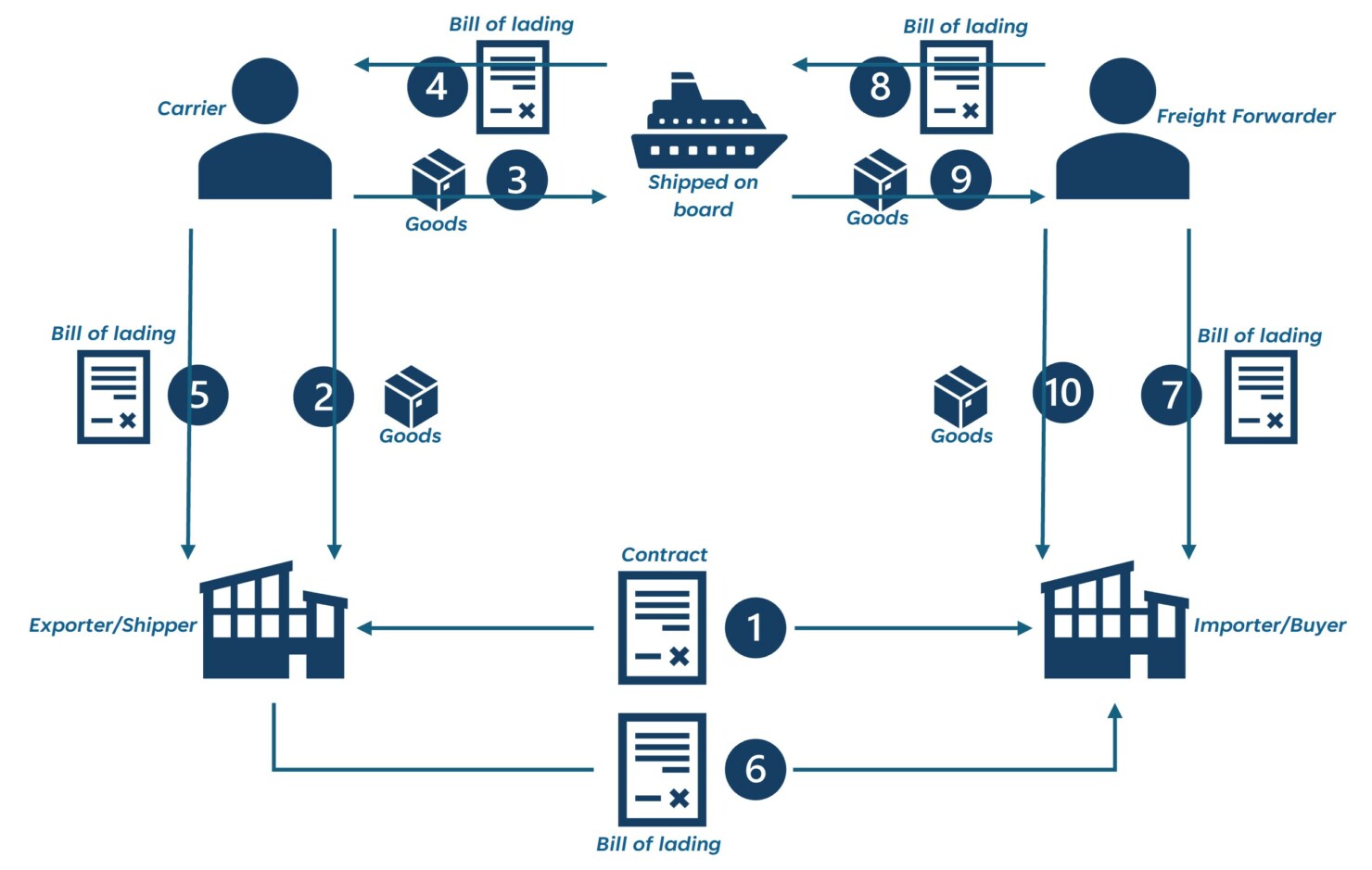

In the context of Trade Finance, the Bill of Lading is an essential document throughout the logistics chain and the trade financing process. This document, certifying the contract between the shipper and the carrier, represents the carrier’s commitment to transport the specified goods to their agreed destination.

The Bill of Lading holds critical importance for several reasons. Firstly, it serves as a title of ownership for the goods during their journey, determining who can dispose of the goods and how. Secondly, it embodies a portion of the terms of the transportation contract, specifying the conditions and obligations of the parties involved in the transaction. It also acts as tangible evidence of the receipt of goods by the carrier, with the commitment to deliver them in the condition received, except in cases of perils and accidents at sea.

However, despite its crucial importance, the Bill of Lading often remains a physical document, issued in paper form, which comes with high costs, significant production, and processing delays, as well as risks of fraud and errors.

Electronic Bill of Lading already exist, but with very limited adoption. Since the transfer of the document is not legally accepted by most of the country’s authorities, it relies on platforms where e‑B/L are exchanged between parties who are required to sign a dedicated agreement.

MELTR could remove this barrier to entry. Electronic B/L could be generated and exchanged without having to sign specific agreement. It also could be transferred from one platform to an other more easily, paving the way to finally broaden the adoption of blockchain platforms and smart contracts.

Broad adoption is key

The adoption of the MLETR regulation could foster the digital transformation of the Trade Finance sector: increased digitization of processes, cost reduction, improved transaction security, and expanded access to financing for businesses are just a few examples of the potential benefits.

The transition to electronic documents would significantly simplify processes, speeding up transactions and reducing risks associated with handling paper documents. Processing times would be shortened, errors minimized, and transaction traceability increased. Blockchain technology could play a key role in securing and certifying information, ensuring data integrity, and reducing the risk of fraud.

Furthermore, the MLETR paves the way for better financial inclusion for small and medium-sized enterprises (SMEs). By making Trade Finance transactions more efficient and transparent, SMEs could benefit from easier access to credit and more opportunities in international markets.

Despite these significant advantages, the full digitalization of Trade Finance still faces significant obstacles. By essence, Trade Finance is global: MELTR needs to be broadly adopted by the country’s authorities to fully unleash its benefits and still requires to gain buy-in from all stakeholders on the value chain, including exporters, importers, banks, insurers and carriers.

(1) ICC 2023_Trade Register Summary