Supply Chain Finance Operating Model

How to structure Supply Chain Finance activity?

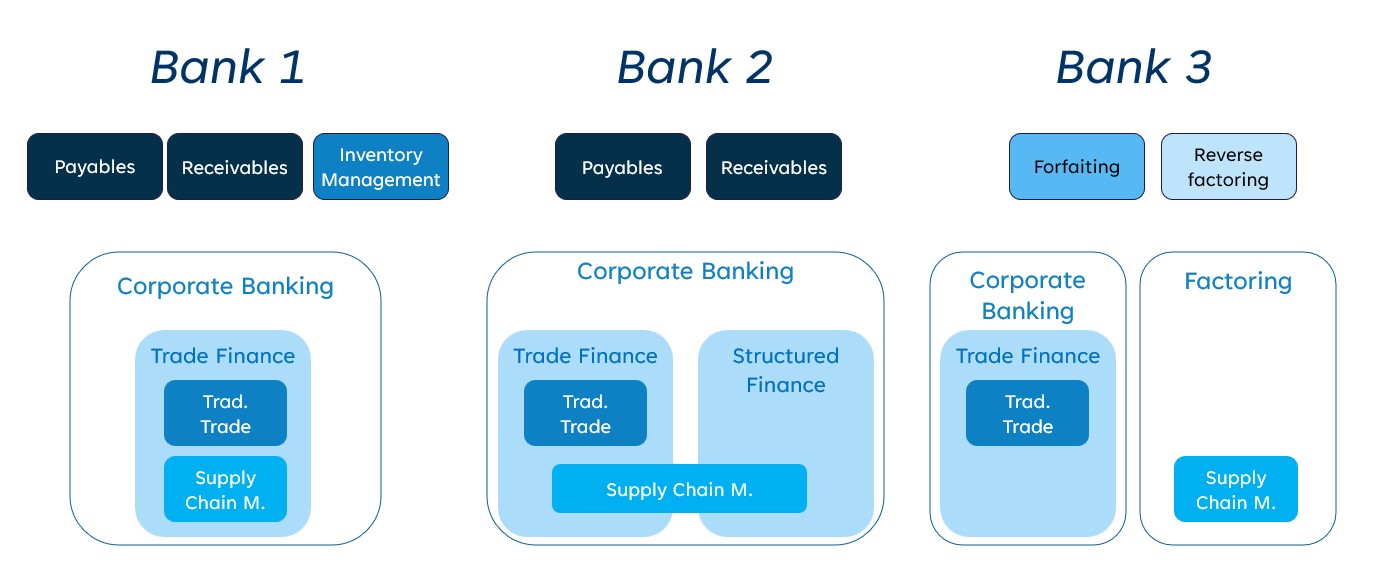

Which Target Operating Model for Supply Chain Finance activity?

Following 10 years of growth, the competition with non-bank actors and strong regulatory constraints (KYC, LAB/FT) motivate to rethink Supply Chain Finance operating model, in order to optimize costs and reduce processing time at the origination.

Operating Model choice is driven by three main criteria:

-

Offer hetogeneous business offers under Supply Chain Finance activity

-

Organization Driven by related business lines

-

Growth perspective Depending on the level of maturity of the activity

Bank 1: Stand alone operating model

Full products offer (payables, receivables, inventory management)

Activity under Trade Finance business line

High growth perspectives, with a 10+ MEUR investment planned over the next 3 years

- Dedicated operations center with dedicated FO to BO systems for payables and receivables, and specific BO system for inventory management

Bank 2: mutualized model

Products offer on Payables and Receivables

Activity shared between Trade Finance and Structured Finance business lines

Strong business push to invest and develop activity with growth projection higher than +15% a year

- Operations processing and IT systems leveraging on Structured Finance set up

Bank 3: integrated model

Products offer close to factoring (forfaiting, reverse factoring)

Activity under factoring business line

Supply Chain identified as growth lever for factoring

- Operations and IT systems fully based on factoring operating model

How we can help

-

Opportunity Study

Evaluate your current operating model and identify opportunities

-

Target Operating Model Design

Devise optimal operating model to support business ambitions

-

Target Operating Model Implementation

Build trajectory and implement changes toward target operating model