Align to regulatory complex environment and leverage business opportunities

How to take advantage of a constant evolving regulatory landscape ?

How to face the challenge of regulatory alignment ?

On March 2018, EU has released an action plan for financing sustainable growth. This political will results in the emergence and revision of several interconnected regulations.

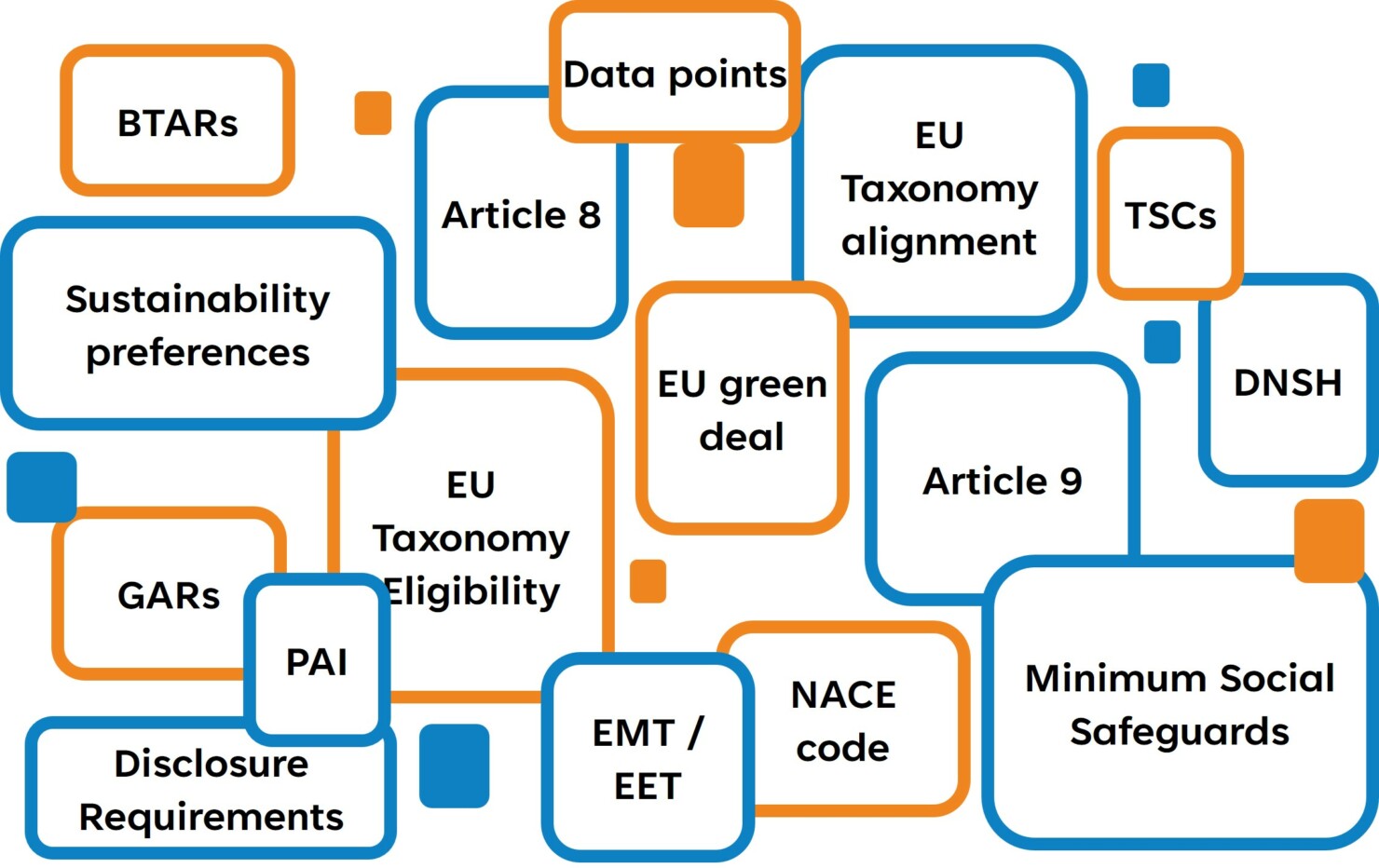

Plethora of regulatory texts

A multitude of barbaric acronyms.

- CSRD — Corporate Sustainability Reporting Directive

- SFDR — Sustainable Finance Disclosure Regulation

- Loi Energie Climat – Article 29

- EU Taxonomy / Taxo4

- MIFID 2 – Markets in Financial Instruments Directive — Sustainability preferences

- Retail Investment Strategy

- ISR label

- ELTIF (European Long Term Investment Funds)

- …

Regulatory framework is embedded across the value chain of the financial ecosystem

The regulation is embedded across the financial ecosystem value chain :

- Corporate companies

- Financial Market Participants (Asset Managers, Insurance, Pension Funds, CIBs)

- Distributors (Wealth managers, Retail banks)

- Private end-clients

This will lead to a virtuous cycle to enhance sustainability across the financial ecosystem.

Impacts are huge and scattered across the value chain. Challenges are not only about regulatory alignment…

The impacts are very different in nature, but in all cases, they are highly impactful. Impacts are ranging from business to operational processes with strong emphasis on data management and IT architecture. Impacts will also differ depending on the role of the FMP – credit institutions, asset managers, private banks…

Challenges are about :

-

Sales & Distribution Reshaping sales / distribution processes for both institutional and private clients and adapting the product universe by selecting products in line with clients’ expectations and regulatory constraints. It will also be about amending the development product processes

-

Risk management Integration of ESG factors into risk management framework (physical & transition risks)

-

Communication Increased transparency will also have a direct impact on how organizations will market and communicate their positioning and offers. Greenwashing and communication misaligned with public information will be widely sanctioned by customers

-

Data & Reporting Transparency is also about enhanced reporting capabilities. Reporting that will require to manipulate thousands of heterogeneous data from internal and external sources

How we can help

-

Regulatory awareness

Understanding the ins and outs of regulatory texts

-

Framing study

Measuring what are the compliance and business impacts

-

Gap analysis

Identifying gaps (governance, data, IT…)

-

Roadmap for implementation

Building implementation roadmaps taking into account regulatory constraints

-

Remediation plan

Supporting remediation plan / Implementating remediation actions