Our expertise

Trade Finance — Transformation levers

How to transform Trade Finance industry

Trade Finance: transformation promises still to unlock

The last decade has shown the first lights of Trade Finance transformation. But massive potential and opportunities remain untapped to revolutionize the industry

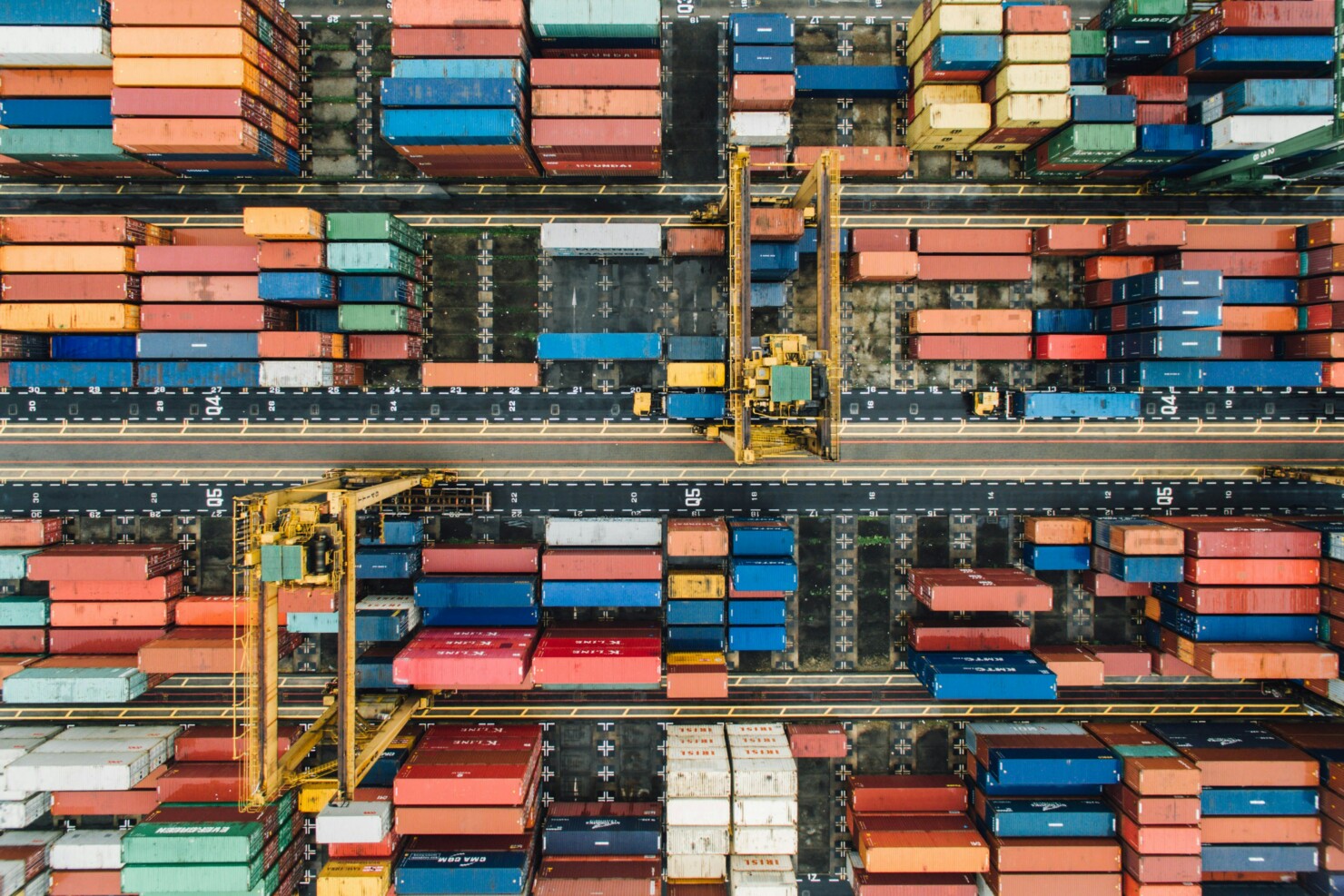

Trade Finance: a contrasting landscape with growth opportunities

-

4.6 % Trade Flow growth projection over the next 10 years

-

-14 pts Expected decrease of Documentary Product in TF products mix for the next decade

-

$2.5 T Estimated Global Trade Finance Gap

Global Trade Flow is expected to grow over the next 10 years

- With a projected growth of 4.6% over the 10 next years, reaching $37.4 trillion by 2032, global trade flow keeps increasing

- Highly correlated, Trade Finance revenues should increase by 3.8% per year from 2022 to 2032, to reach $91 billion

With contrasting evolution depending on Trade finance products

- Documentary Products revenues are still expecting to grow for the next decade. The decrease of their part within the overall TF products versus Open Account is expected to level off, documentary products enabling a better risk mitigation in the current context

- After the boom of Supply Chain financing within Global TF revenues, last projections forsee a more stable trend in the next decade

And opportunities to expand the business

- SMEs financing needs remain a segment to address: the Asian Development Bank has reassessed the Global Trade Finance Gap (3) to $2.5 trillion in 2022 (+$0.8T versus 2020)

- Trade Finance has a key role to play to promote sustainable trade by proposing incentives and advising corporates on the decarbonization of their supply chain

Trade Finance stakes and levers

-

Stakes

Facing a competitive market…

Maintain profitability despite pressure on prices

- Optimization of processing cost and Turn Around Time remain the cornerstone of Trade Finance profitability, especially during issuance and document checking processes steps

Meet increasing client expectation on added value services

- Service quality, smooth client journey, real time transparency and traceability of the processing of the operations are part of the major client expectations, especially since the appearance of new Fintech actors promising qualitative client experience

… In a strained environment

Comply with evolving compliance and regulation constraints

- Trade Finance activity is highly sensitive to AML/FT risks, requiring comprehensive controls on the significant amount of documents and on the monitoring of the goods transportation. Inherently global, the activity must as well take into account local regulations

Adress aging system limitations

- Renewal of Trade Finance information systems might be necessary to support business development ambitions, in order to optimize processes, propose new services, partner with innovative actors, anticipate obsolescence or as part of the cloud strategy of the bank

-

Levers

First: choose your operating model

2 models co-exists, both relevant depending on your business model:

- Focus on client proximity, with strong client support to retain customers

- Choose high touch vs. low touch approach, with streamlined and industrialized process for vanilla products and expertise and customized client support for high value products

Regardless of the model, digitize and digitalize

Stay client oriented and promote self care e‑banking services when relevant

- Provide Corporate client e‑banking customizable services (reporting, auto-filled request for L/C or guarantees issuance…); Promote cross-selling, in line with client expectation and local market trends

Reduce cost-to-serve and Turn-Around-Time, taking into account compliance constraints:

- Develop OCR capabilities for Documentary Checking; Enhance STP chains to better monitor the activity; Automate Compliance controls with screening capabilities and optimize and secure KYC processes

Prepare to the next generation of technologies

- Develop Platform in association with Fintechs; Pursue Blockchain initiatives and monitor challenges to be overtaken to ensure broad adhesion

How we can help

-

Organization, IT & Operations assessment

Identify & prioritize challenges and opportunities based on as-is analysis

-

Target Definition

Define Target Operating Model addressing Business ambitions and IT and Operations stakes

-

Roadmap, business cases & budget definition

Detail project business case and roadmap and build transformation budget