CSRD — Non Financial Reporting

CSRD aligns disclosure requirements for financial and extra-financial reporting with the production of a sustainability report

Directive CSRD – Corporate Sustainability Reporting Directive

Standardization of non-financial information

The Corporate Sustainability Reporting Directive (CSRD) constitutes a revision of the current European Non-Financial Reporting Directive (NFRD) governing the disclosure of non-financial information.

In France, the new provisions will replace the extra-financial performance statement (DPEF).

Entities already subject to the requirement to establish a DPEF will be subject to CSRD obligations from January 1, 2025 (based on 2024 data). For other entities, there will be a progressive implementation schedule.

The objective is to align the data production requirements for financial and non-financial reporting in an ecosystem where both dimensions will take on equal importance.

A reporting that will have to comply with a new normative framework

Main change:

Expansion of the scope of information to be disclosed

- Goals of aligning the business model and strategy with the objective of climate neutrality by 2050

- Qualitative and quantitative ambitions, and the trajectory

- Results/progression compared to ambitions

- Company’s value chains (and the identification of upstream and downstream relationships)

- Role of administrative, management, and governance bodies

- Most significant negative impacts

- Methodologies on information identification

- …

Introduction of double materiality (dual perspective)

The challenges must be assessed from a dual perspective:

- Impact materiality: the impact of the organization’s activities on people and the environment (‘inside out’)

- Financial materiality: the impact of the environment and external stakeholders on the organization’s performance (‘outside in’)

On these two axes, the challenges must be assessed with scoring models (that incorporate mandatory criteria).

Materiality must be assessed with stakeholders throughout the value chain.

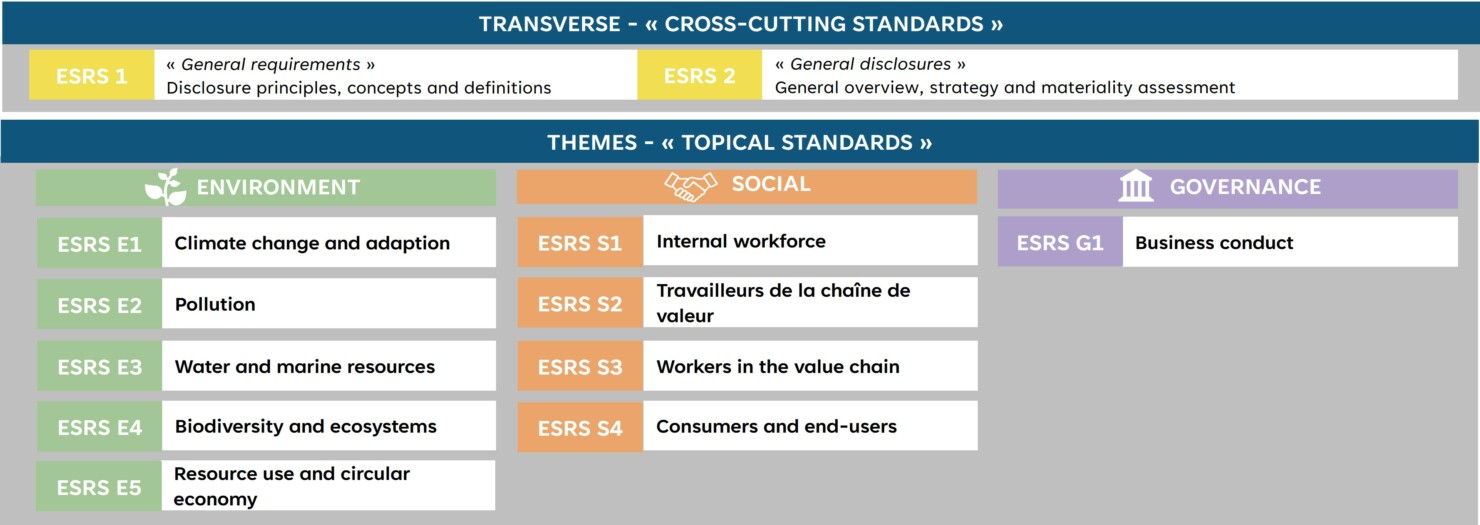

Comprehensive overview of the published ESRS to date

A first set of ESRS standards containing 12 sustainability reporting standards covering the 3 ESG subjects from a sector-agnostic perspective – universal standards (delegated acts to be published by July 31, 2023).

The materiality approach according to the CSRD must take into account the impacts, risks, and opportunities related to the company through its direct and indirect business relationships in the upstream and downstream value chain.

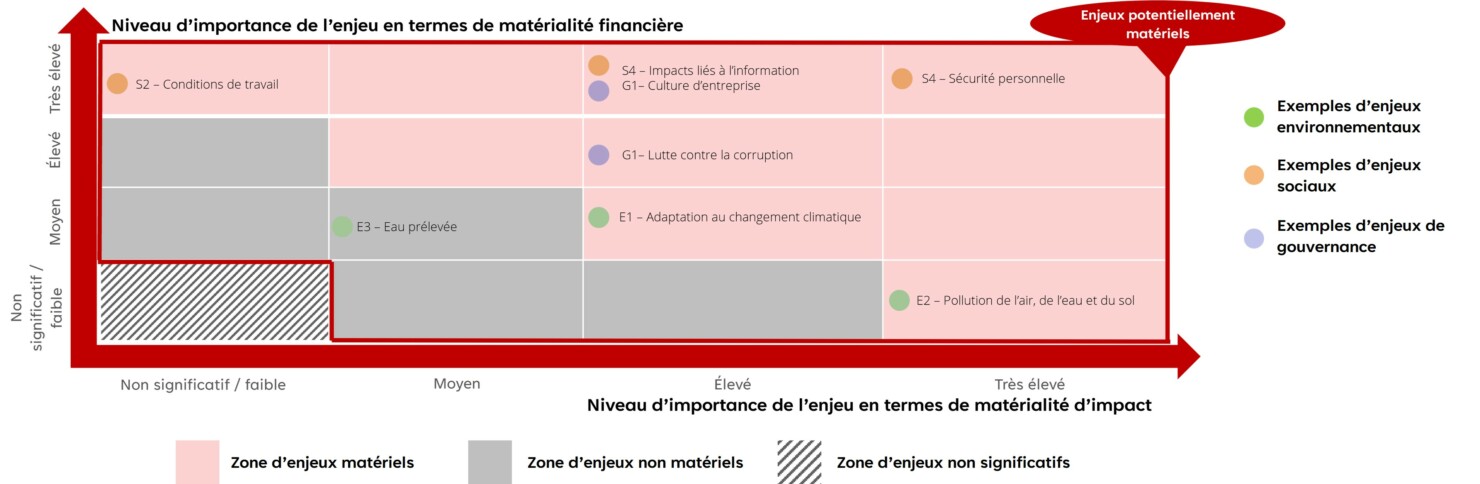

Double materiality matrix : Impact x Financial

The results of the stakeholder’s consultation allow for an evaluation (scoring on the impact materiality and financial materiality dimensions) for each issue, which then helps to place that issue on the matrix.

The zone of non-significant topics corresponds to the issues for which no ambitions will be set, nor communicated in its non-financial reporting.

For the remaining issues, the boundary between the zone of material and non-material issues is to be set the entity : the zone of material issues includes the issues that will be subject to specific disclosures in the sustainability report.

A progressive implementation schedule

Here is a summary of the progressive implementation schedule:

- As of January 1st, 2024 (initial publication during the calendar year 2025) for companies already reporting under NFRD.

- As of January 1st, 2025 (initial publication during the calendar year 2026) for large companies not currently subject to NFRD and meeting at least two of three criteria (balance sheet €20M+ / revenue €40M+ / more than 250 employees).

- As of January 1st, 2026 (initial publication during the calendar year 2027) for SMEs meeting at least two criteria (balance sheet €4M+ / revenue €8M+ / more than 50 employees). SMEs will be subject to a limited set of standards than the general set of CSRD standards.

- As of January 1st, 2027 (initial publication during the calendar year 2029) for non-European companies meeting specific criteria (company listed on EU regulated markets + annual net turnover in EU territory of €150M+ + subsidiary in the EU).

How we can help

-

Stakeholder engagement

Identification & questioning of stakeholders (including expert analysis)

-

Materiality scoring for each ESG topics

Scoring of positive and negative impacts, risks and opportunities

-

Double materiaity matric

Impact x Financial materiality

-

Mandatory requirements (disclosure requirements / data points)

Scope of mandatory disclosure requirements and data points

-

Implementation roadmap

Implementation for sustainable report production