Insights and perspectives

ELTIF 2.0: A new lease of life for long-term investments in Europe ?

On 25 October 2024, the Regulatory Technical Standards (RTS) of ELTIF 2.0 were published in the Official Journal of the European Union. This publication marks a crucial step in the implementation of reforms aimed at revitalising long-term investment in Europe.

As a reminder, the ELTIF (European Long-Term Investment Fund) is an investment fund designed in 2015 in its version 1.0 to channel capital towards long-term projects, such as infrastructure, real estate, and SMEs. These funds aim to provide investors with capital growth and portfolio diversification, while supporting sustainable and responsible initiatives.

ELTIF funds are particularly suitable for investors who are looking to make a long-term commitment and do not have significant short-term liquidity needs. However, the first version of the ELTIF encountered several obstacles, including regulatory restrictions and limited access for retail investors (too high a threshold), which justified the introduction of an improved version (2.0).

Overview of savings in France

In 2024, French household savings remain at high levels, with a savings rate of around 17.5%. The French continue to favour risk-free savings products, such as regulated savings accounts and Euro funds for life insurance contracts, despite often low returns. This caution is partly due to ongoing economic uncertainty that is pushing some investors to favor liquid savings. In addition, responsible savings are gaining in popularity, especially among the younger generations.

At the same time, some more affluent investors are looking for diversification and higher returns. This translates into significant growth for the private equity market in France. In 2023, investments in this sector reached record levels, with a volume of net household investment of €22.4 billion in assets under management in the fourth quarter. Investments in private equity, and in particular ELTIF funds, are particularly attractive to investors looking to support the real economy and engage in positive impact projects.

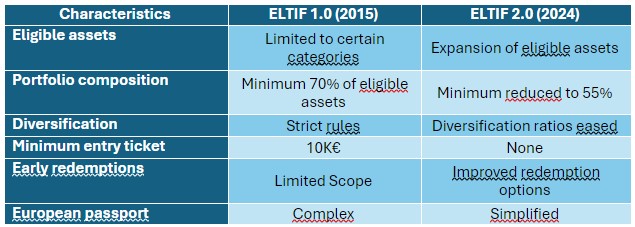

ELTIF 1.0 to 2.0: Summary of the main changes

ELTIF offer statement (situation as of 10/15/24)

In Europe, several management companies have already launched one or more ELTIFs since the launch of version 1.0 in 2015, ESMA indicates the existence of 140 approved funds, of which nearly 85% are represented by Luxembourg (65%) and France (20%)

The main asset management companies that have approved one or more ELTIFs in France and Luxembourg (source ESMA) are Azimut Investissements (19 funds), Amundi (10 funds), BNP AM (5 funds), Blackrock AM (5 funds) and Pictet AM (5 funds).

Main differences between version 1.0 and 2.0

For private customers:

- Simplified access : ELTIF 2.0 allows a larger number of retail investors to participate, with a minimum investment threshold removed (the main obstacle to the development of version 1.0). The threshold of €10,000 for investors with less than €500K disappears in version 2.0. This opens the door to new investors who previously could not invest in these products.

- Portfolio diversification : Clients now have wider access in terms of asset class, which allows for better diversification, including in unlisted assets. This offers a potentially higher return and better resilience to market volatility.

- Sustainable investments : With greater flexibility to invest in sustainable projects and green infrastructure, clients can align their investments with their environmental and social values (financing renewable energy projects, thus contributing to the energy transition while achieving attractive returns).

For professionals of the sector

- Fundraising Opportunities : Fund managers can raise capital not only from institutional investors but also from retail investors, expanding their investor base.

For example, a management company can launch an ELTIF fund dedicated to infrastructure, attracting both institutional investors and individuals interested in this growing sector. - Better liquidity management: By changing the threshold of eligible assets from 70% to 55%, this will allow the manager greater leeway in carrying out his investment policy and allow for better liquidity management (dealing with redemption requests).

- Administrative simplification : The simplification of administrative procedures reduces the costs and time associated with the creation and management of ELTIF funds, allowing managers to focus more on investment performance (launch time reduced to a few months from more than a year previously).

Future transformation challenges

The introduction of ELTIF 2.0 brings several transformative challenges for professionals in the long-term investment fund industry:

- Evolution of investment policy : The new rules allow for greater flexibility in the types of eligible assets, which offers fund managers the opportunity to further diversify their portfolios.

- Marketing & Sales : The removal of minimum investment thresholds and distribution constraints opens up the ELTIF market to retail investors, which requires adapted marketing and communication strategies to attract this new clientele.

- Promotion of sustainable finance : ELTIF 2.0 will further develop investments in sustainable projects, aligned with the objectives of the European Green Deal.

- Structural innovation : New co-investment opportunities and master-feeder structures offer more sophisticated investment options, requiring adaptation of management skills and strategies.

- Regulatory compliance : Fund managers should familiarize themselves with the new regulatory requirements and adapt their compliance practices to remain compliant with ELTIF 2.0.

- Evolution of investment policy : The new rules allow for greater flexibility in the types of eligible assets, which offers fund managers the opportunity to further diversify their portfolios.

These transformations present both challenges and opportunities for industry professionals, who must adapt quickly to take advantage of the new rules and maximize benefits for their customers.

Summary and next steps

ESMA data show that ELTIF 1.0 remains quite anecdotal in the range of asset managers (approx. €2.4 billion collected since the launch in 2015). The stakes are therefore very high for version 2.0, which must have the capacity to meet the strong customer demand for unlisted companies.

Following the publication of the RTS, we will have to wait a few weeks to see the full translation of the new ELTIF 2.0 rules, with initial feedback expected at the end of Q4 / early 2025.

Then, for the next few months, the need for the sector to remain mobilized with the administrations in order to set up “tax incentives” for investors to subscribe to ELTIF 2.0.

This is in order to meet one of the States’ priorities: to find sources of financing for the real economy, as A. Macey of Natixis IM points out, “by facilitating the construction of renewable energy infrastructure, schools, hospitals, as well as the consolidation of SMEs, this would create jobs and improve living conditions throughout the EU”.