Asset Management — B2C fund distribution leveraging blockchain technology

Use Case

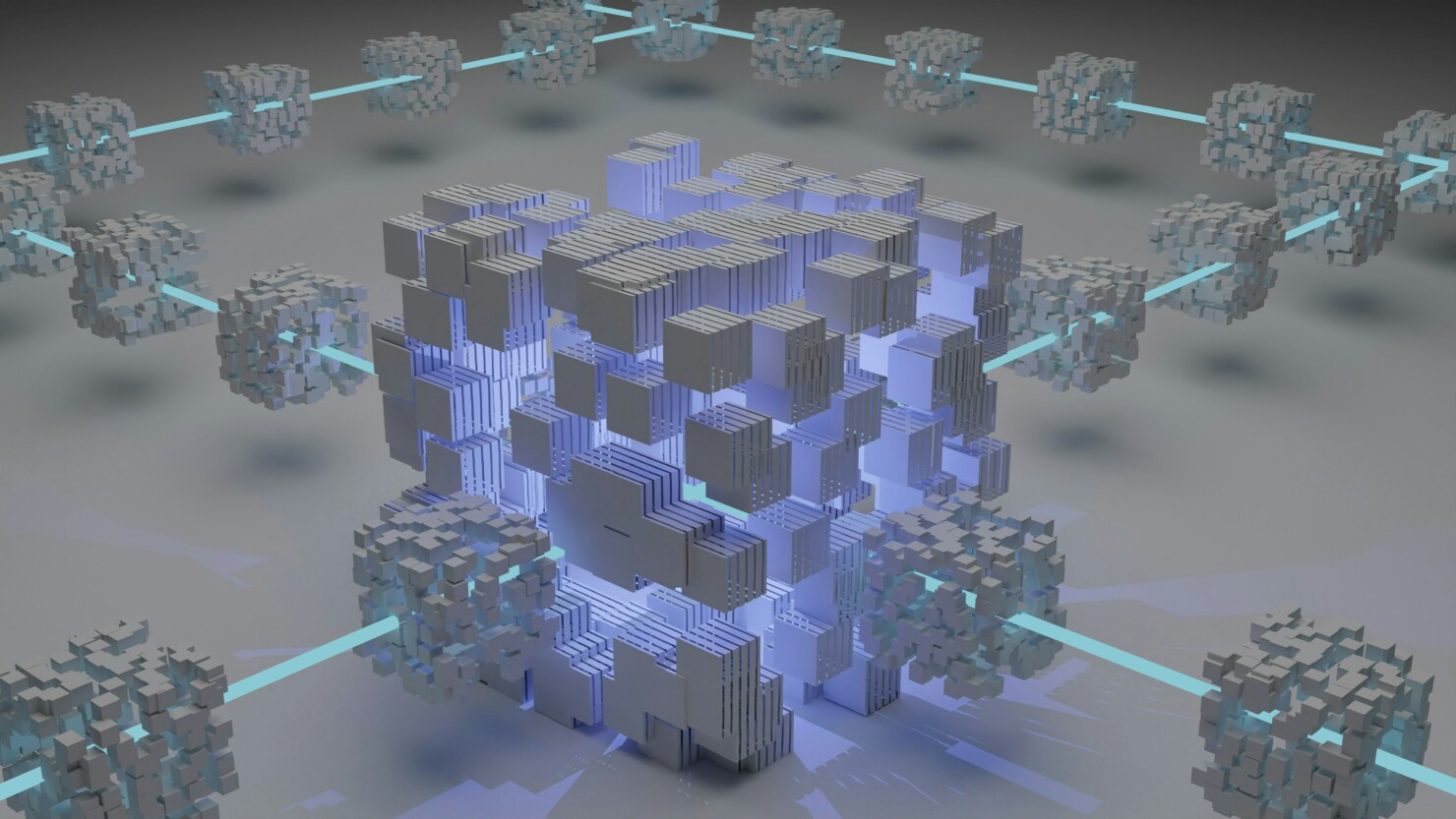

B2C fund distribution leveraging blockchain technology

Life insurance company that designs and manages savings and retirement plans for customers of a major banking network

It has recently implemented a solution that enables it to manage various key functions of its business (unit-linked order book, position keeping, matching, retrocessions, etc.) in an industrial and secure way

A growing number of market players (institutions, insurers, management companies, etc.) are using blockchain solutions to streamline and secure their value chain, and to reduce certain costs (order placement, asset custody, etc.)

The aim is to support this insurer’s innovation department in this opportunity study phase for the subscription and custody of assets (fund shares) via a Blockchain platform

-

Approach

Workshops and use cases

- Presentation of Blockchain platforms (Key principles, Ecosystem, Pricing model…)

- Definition of the target IT architecture & impacts on the insurer’s operating model

- Workshops to present solutions in the customer context

- Identification of evolutions to be carried out (IT, Processes, Legal…)

- Cost/time estimates for each solution

- Projections of Unit-Linked referencing on each platform in line with the Unit-Linked universe marketed

Selection of Blockchain solutions

- Challenges, objectives and scope of study

- Analysis of solutions (SWOT)

- Estimated schedule and implementation milestones

- Project profitability assessment (project implementation & operating costs vs. estimated solution gains)

-

Résults

- Identification of all impacts at value chain level

- Justification of the simplification of the operating model associated with the use of a Blockchain platform for investment activities

- Assessment of project payback and ROI

- Exploration of other use cases for the use of Blockchain (Data Provider, Retrocessions…)