Insights and perspectives

Insurance white-label distribution

White-label distribution in the insurance sector represents a strategic opportunity for insurers seeking to diversify their distribution channels and increase their market presence without necessarily investing in the development of new brands.

This approach allows insurers to offer their products under a white-label or gray-label arrangement, often using a partner’s brand that already has an established customer base. They can include banks, retailers, or other companies with strong customer relationships.

It enables insurers to move upstream in the value chain, closer to specific customer needs, and to offer insurance services at key moments within an already well-established customer journey.

Benefits for insurers

-

Market expansion White-label distribution enables insurers to enter new market segments without the costs associated with creating a new brand or building a distribution network.

-

Cost reduction By partnering with organizations that already have an established customer base, insurers can lower customer acquisition costs.

-

Flexibility and innovation This model provides the flexibility to quickly tailor products to the specific needs of the partner’s customers, thereby fostering innovation.

White-label distribution : 3 key challenges

- Brand management: It is crucial to maintain the quality and reputation of the original brand while operating under another brand. This requires rigorous management of service and product standards.

- Strategic alignment: Insurers must ensure that their strategic objectives are well aligned with those of their partners to avoid conflicts of interest.

- Regulation: Insurers must navigate a complex regulatory framework, ensuring that all operations comply with local laws and regulations.

Key steps for implementation or distribution strengthening

-

Partner selection

Identify and assess potential partners who share similar values and have a strong reputation in the market.

-

Offer development

Adapt insurance products to be compatible with the partner’s brand while preserving their intrinsic value.

-

Implementation of integrated systems

Ensure seamless technological integration between the insurer’s systems and the partner’s systems for effective data and process management.

-

Monitoring and optimization

Establish performance indicators to track the success of white-label distribution and adjust the strategy based on the results achieved.

-

Training and support

Provide adequate training and continuous support to partners to ensure they fully understand the products and can sell them effectively.

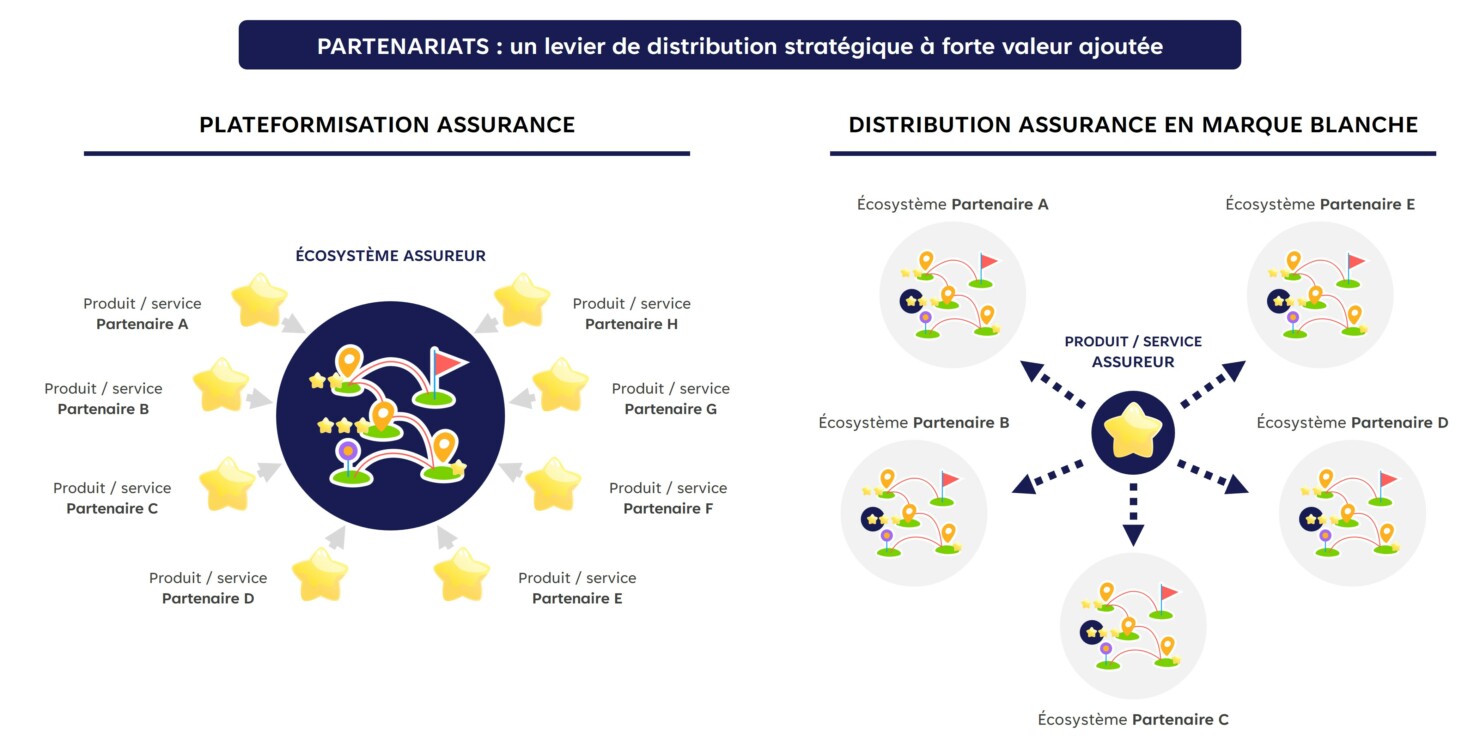

A service trend among insurers: platformization vs. white-label distribution

Platformization in the insurance sector is a clear trend that involves creating digital ecosystems where various products and services are offered through a single platform. This approach allows insurers to centralize their offerings and collaborate with third parties to enrich their service catalog. Platformization also enables better analysis of customer data, thereby allowing for more personalized offerings and improved user experience.

White-label distribution and platformization are two complementary strategies that can help insurers adapt to market changes and meet growing consumer expectations for personalization and convenience. Insurance is thus more ‘packaged’ within a more complete and coherent customer journey, highlighting key moments for proposing these offers.