Insights and perspectives

Retail Investment Strategy — Smooth transition or model disruption ?

What the retail investment strategy aims to achieve ?

One of the key three objectives of 2020 Capital Market Union (CMU) action plan was « to make the EU an even safer place for people to invest their savings in the long term ».

In that context, on 24 May 2023, the European Commission (EU) released a Retail Investment Package which aims to improve the framework so that consumers are empowered to take informed financial decisions and to get adequate protection.

The package is amending the current legislative structure with the objective to :

- Increase retail investors’ participation in EU capital markets

- Enhance trust and confidence in capital markets

- Help retail investors to achieve better outcomes

- Contribute to the wider EU economy

Retail Investment Strategy final objective is to streamline and modernize the applicable rules to place customers’ interests at the centre of retail investing and ensure that retail investors receive the same treatment and protection regardless of the investment products, marketing and distribution channels

What are the drivers for change ?

The reasons why the European Union deemed it necessary to strengthen the regulatory context are multiple:

- Retail investors struggle to access relevant, comparable and easily understandable investment product information to make informed investment choices

- Retail investors are increasingly at risk of being unduly influenced by misleading marketing on social media and new marketing channels

- Financial advice may not always be in the best interest of retail investors (due to shortcomings in the distribution linked to potential conflicts of interest that arise from the payment of inducements)

- Some investment products do not always offer value for money to the retail investor (unjustifiably high costs and charges)

- Applicable rules differ from one financial instrument to another and may be inconsistent, making the cumulative requirements confusing

- Need to increase the levels of financial literacy

Some figures well illustrate that situation:

- 17% of EU household assets were held in financial securities in 2021 well below US households (43%)

- 40% higher fees are paid by retail investors compared with institutional investors

- 40% of Europeans are not confident that the investment advice they receive from financial intermediaries is in their best interest

What are the impacts on current legislative framework ?

Retail Investment package is made of two parts:

- An omnibus directive (Retail Investment Strategy) that revises multiple segments of existing legislation : MiFID, IDD, Solvency II, UCITS, AIFMD

- An amending regulation : PRIIPs

Thematics are spread over 9 sections :

What are the key measures ?

Key measures by topic are (non-exhaustive list):

Disclosure of information

Investment firms will have to display appropriate risk warnings in all information materials (including marketing communications) to alert retail investors on the specific risks of potential financial losses concerning particularly risky products.

Pre-contractual disclosures on costs, associated charges and payments made by third parties are also reinforced. Moreover, intermediaries distributing insurance-based investment products to provide all retail clients and customers with an annual statement providing, among other things, information on costs and charges, including third party payments, and performance.

Bias in advice process

Ban on inducements paid from manufacturers to distributors in relation to the reception and transmission of orders, or the execution of orders to or on behalf of retail clients (execution only services). A review clause is introduced to assess the effects of third-party payments on the retail investor segment 3 years after the transposition of this Directive, in order to determine whether the potential conflicts of interest caused by third-party payments have been reduce. It may lead to a full ban of inducements.

A new test with clear criteria is introduced (a test which replaces the existing ‘quality enhancement’ test of MiFID, and the ‘no detriment’ test of IDD). To act in the best interest of their clients and customers, financial advisors have to, among other things, base their advice on an assessment of an appropriate range of financial products, recommend the most cost-efficient financial product from the range of suitable financial products, and offer at least one financial product without additional features which are not necessary to the achievement of the client’s investment objectives and that give rise to so that retail investors are presented also with alternative and possibly cheaper options to consider.

Product oversight and governance

New requirements on manufacturers to set out a pricing process allowing for the identification and quantification of all costs and charges, and an assessment of whether such costs and charges do not undermine the value which is expected to be brought by the product (same for distributors on distribution costs and charges. Objective is not to approve products that deviate from the industry benchmark. A mandate given to ESMA and EIOPA to develop, make publicly available and regularly update cost and performance benchmarks against which the manufacturers must compare their products prior to offering them on the market. Reporting obligations for manufacturers and distributors towards ESMA and EIOPA are introduced, concerning the data on costs, charges and performance of PRIIPs.

Suitability and appropriateness

Appropriateness: Obtain and assess information related to the capacity to bear full or partial losses and risk tolerance for complex products. In case of a negative appropriateness assessment, the intermediary may only proceed with the transaction at the client’s explicit request (demand of client and acceptance of the firm are to be recorded)

Suitability: Need for portfolio diversification will be added as one of the elements that distributors need to assess when considering the suitability of a specific product or service (on the basis of on information obtained from the client or customer, including information on any existing portfolios)

Marketing and communications

New requirements related to marketing policy, controls, record keeping and reporting to management bodies are introduced.

New obligations to clearly identify marketing communications and to ensure they are appropriately attributed to the investment firm, insurance undertaking or insurance intermediary by which or on whose behalf they are made. Marketing communications and practices should also be developed, designed and provided in a manner which is fair, clear and not misleading, and should be balanced in their presentation of risks and benefits.

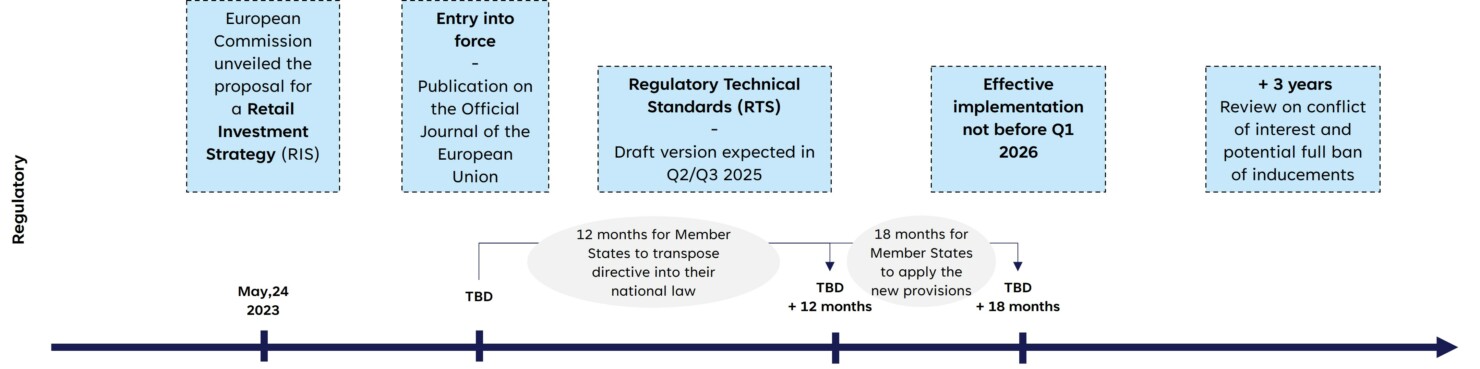

What is the regulatory timeline ?

How big are the changes ?

Distributors business and revenue model are directly impacted

The ban of inducements on execution-only and increased transparency on costs and charges for clients are putting distributors revenue model at risk. Moreover, the revenue split between manufacturers and distributors will benefit to manufacturers and will push for more vertical integration.

Distributors will need to shift from indirect revenues (based on inducements) to direct revenues (advisory services) . It means shifting clients from execution only to advisory or discretionary management and acculturate clients to “price of advisory” with awareness and communication on rationale and value added of inducements.

Manufacturers will also have to adjust product range and costs structure

Even if building consistent benchmarks on costs & charges given differences in fund strategy may be a north face for ESMA & EIOPA, benchmark on costs and charges together with new pricing process will introduce higher transparency and lead to a convergence of funds and distribution costs & charges. Moreover, premium to non-complex products or products the best performance/costs ratio (i.e trackers / index funds with easier value for money to demonstrate) will require for manufacturers to rationalize range of funds with either low cost or higher performance.